Mastering Equity Management in Partnership with Carta through Scenario Modeling

Introduction

Picture this: You're a founder, tirelessly working to build your startup from the ground up. You've poured your heart and soul into your vision, and now you face a critical challenge: providing an accurate cap table to potential investors. As you stare at the messy Excel sheet filled with complex calculations and questionable accuracy, a sense of unease sets in. Not only are you struggling to present a clear cap table to investors, but you also find yourself unable to decipher the implications of the term sheet you've just received.

It's a daunting situation, but worry not, valiant founder, for Finprojections and Carta are here to save the day!

In this article, we'll delve into the importance of equity management and reveal how the dynamic partnership between Finprojections and Carta can empower your startup to conquer scenario modeling with confidence. With their combined expertise, you'll transform the challenges of equity management into opportunities for growth, ensuring you can provide investors with a clear and accurate cap table while understanding the consequences of each term sheet. So, get ready to embark on a journey to master the art of startup equity management and unlock the full potential of your venture!

The Power of Scenario Modeling for Equity Management

Scenario modeling is a crucial tool that enables you, as a startup founder, to plan and make informed decisions based on different financial outcomes. By understanding and implementing scenario modeling, you can navigate the complexities of your equity structure, allowing you to make strategic decisions about fundraising, equity distribution, and exit strategies. Here, we outline the four key steps in scenario modeling:

The Four Key Steps in Scenario Modeling

- Step 1: Setting Up Your Cap Table

A well-organized and accurate cap table is the foundation of effective scenario modeling, outlining the ownership structure of your company. Keep in mind that a cap table can quickly become complex with outstanding convertibles, SAFEs, warrants, and both vested and unvested options. It's essential to methodically and accurately capture all of these elements, and the terms under which they convert into equity.

- Step 2: Generating Scenarios for Term Sheets

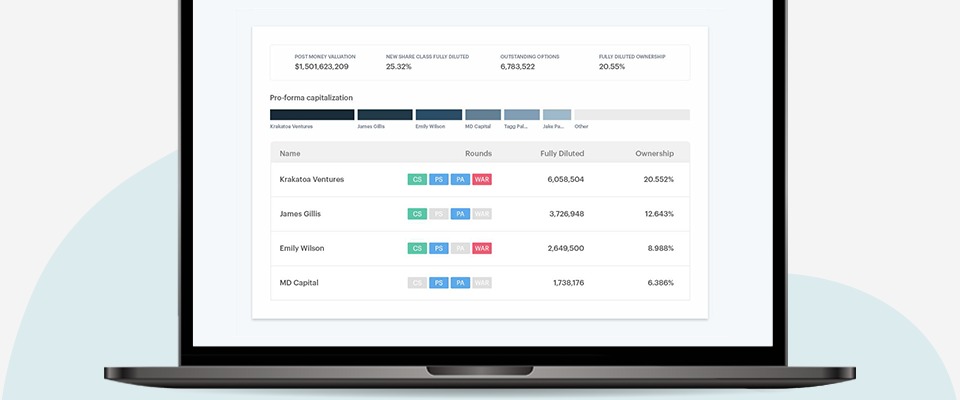

You can use Carta to generate different financing scenarios based on the term sheets you receive, allowing you to compare the impact of various investment offers.

Source: Carta Round Scenario Modelling

Source: Carta Round Scenario Modelling

- Step 3: Analyzing Post-Finance Cap Table and Dilution

Analyzing post-finance cap tables helps you understand the dilution effect on founders and shareholders, optimizing your ownership structure.

- Step 4: Pre-IPO and Late-Stage Round Exit Scenarios

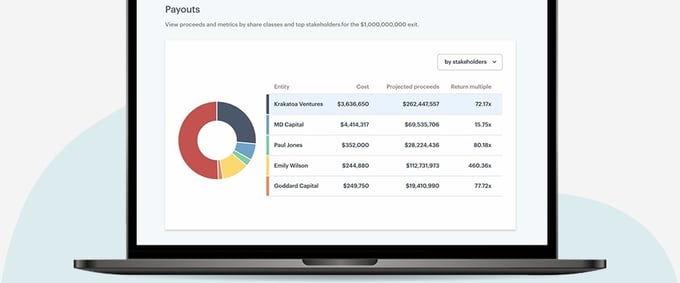

As your startup nears a liquidation event, such as an IPO or potential sale, it becomes increasingly important to focus on exit scenarios while raising late-stage funding rounds. Carefully modeling the impact of liquidation preferences and any special exit rights assigned to each class of shareholders, including those being offered to prospective new investors, is crucial for making well-informed decisions about your startup's equity management strategy.

Source: Carta Exit Waterfall Modeling

Source: Carta Exit Waterfall Modeling

Finprojections and Carta: A Winning Partnership

Finprojections, a leading fractional CFO platform for startups in South East Asia, has joined forces with Carta, a globally leading equity management platform, to provide you with comprehensive solutions for your equity management needs. With this partnership, you can leverage the power of scenario modeling and Carta's cutting-edge technology for seamless equity management.

- Why Carta's Platform Is Perfect for Your Startup

Carta's equity management software offers you a hassle-free way to manage your cap table. With automated updates, you no longer need to worry about maintaining multiple spreadsheets and dealing with manual data entry errors. Carta's platform ensures that your cap table is always up-to-date and compliant with every issuance of electronic securities, allowing you and your team to focus on growing the business.

- Expert Guidance from Finprojections

While Carta's software simplifies cap table management, Finprojections offers expert guidance to help you navigate the complexities of equity management. As a fractional CFO platform, Finprojections works closely with you to set up and maintain your cap table on Carta, run scenario models, and provide strategic advice on fundraising and exit strategies.

By combining the technical capabilities of Carta's platform with the expertise of Finprojections, you can make informed decisions about your equity structure and drive your business towards success.

In Conclusion

Effective equity management is essential for your startup's success, and the partnership between Finprojections and Carta can help you confidently navigate the complexities of equity management, fundraising, and exit strategies.

To learn more about how Finprojections and Carta can help your startup, feel free to book a free consultation session with us.