We can put feet on the ground to supplement your diligence efforts

Covid-19 travel restrictions have made in-person diligence impossible. We can help you maintain your rigor of diligence by leveraging our network of experts in Asia who will visit your target and conduct in-person management interviews.

Our automation tools for fund reporting will unlock savings and efficiency

Build fund cash flow scenarios, generate fair market valuations, and track fund P&L all one spreadsheet. Generate visualizations to simply copy and paste into your investor presentations. Our tools can be customized according to your investment strategy and LP requirements.

Leverage our impact measurement tools to weave ESG and impact into your portfolio

LP investors are increasingly calling for evidence of sustainability and impact in venture capital. We can help you craft your impact narrative with impact measurement tools closely aligned with globally accepted frameworks such as the Operating Principles and UN SDGs.

You can hire us for:

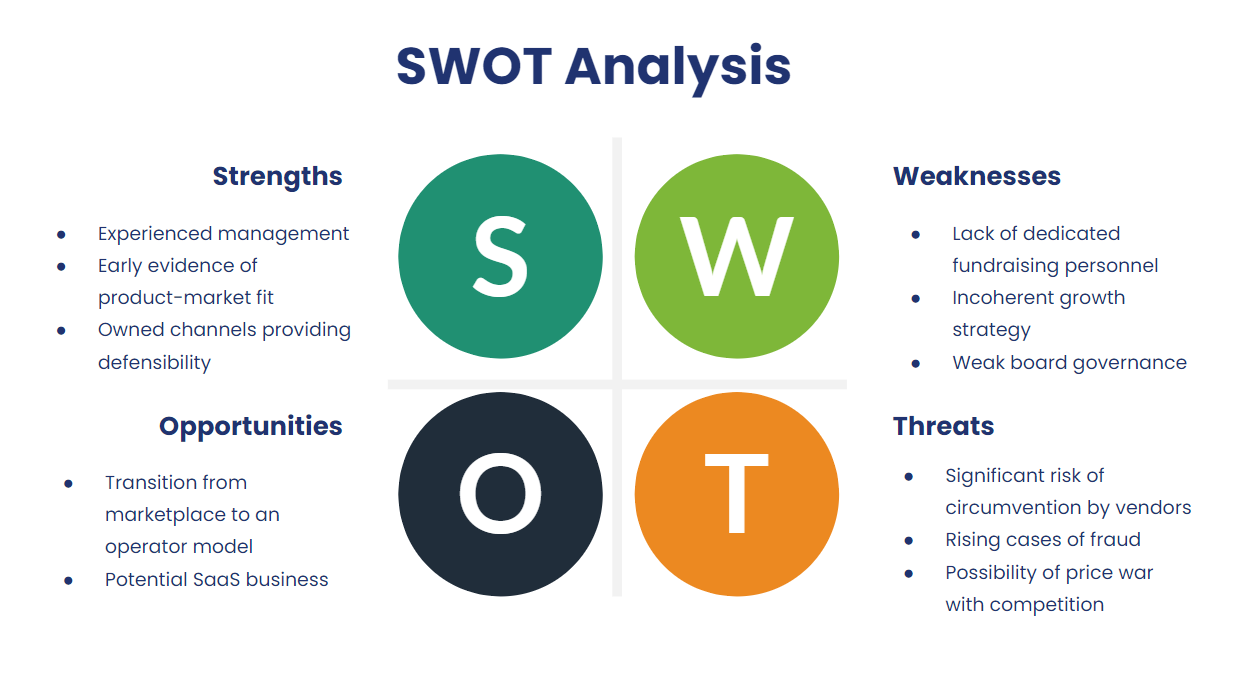

Diligence reports for Asia based companies

Can't travel to Asia to conduct diligence? We can visit companies on your behalf and diligence your target extensively.

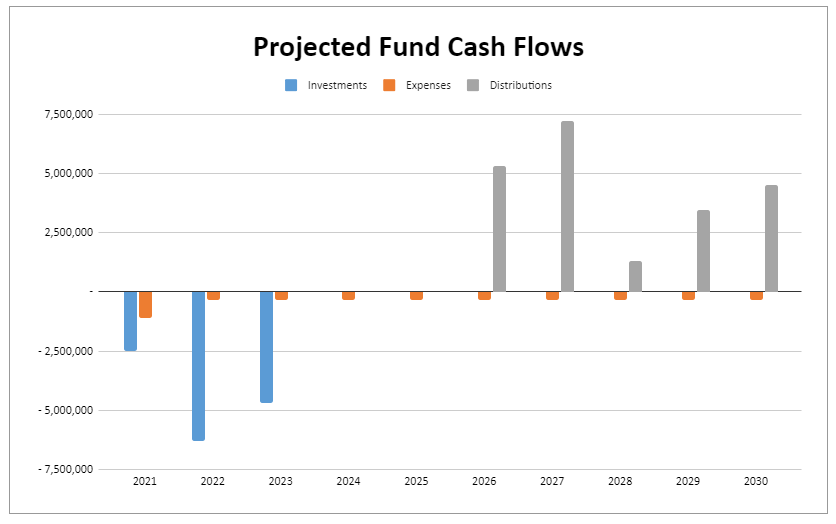

Fund Models and LP Reporting Tools

From scenario planning of investments to fund cash flow projections, our models will deliver to your specifications. We can build additional modules to automate investor reporting.

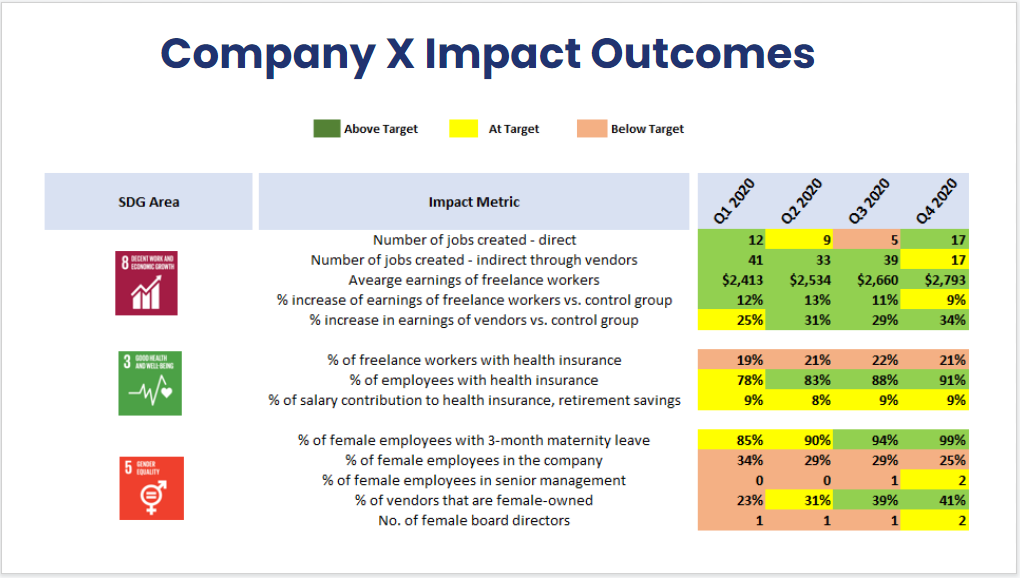

Impact Measurement Tools

Struggling to design frameworks and tools for impact measurement? We can help you build simple but effective tools for impact tracking mapped to SDGs and globally accepted frameworks.